Why You Need Wedding Insurance

If you’ve ever worried what would happen in the event of a wedding disaster, you should look into wedding insurance. Start by reading our rundown below.

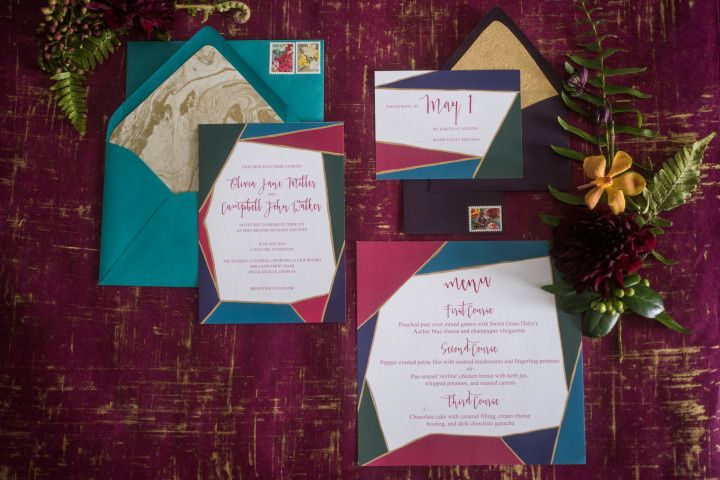

Photo: Eric & Jamie Photography

Insurance is all about protecting the most important things in life - your health, your home, your vehicle and your business, for example. It’s a chance to hedge your bets, safeguarding you, your loved ones and your assets against unexpected catastrophes. So why not insure the biggest day of your life?

Wedding insurance is practical, but few choose to purchase it - and many don’t even know it exists. For an event so often fraught with unwelcome surprises, you’d think more people would be interested in purchasing some peace of mind. When you’re spending big bucks on a special occasion, you might as well do it with confidence.

What is wedding insurance?

Wedding insurance pays for lost deposits, property or personal damage, stolen goods and loss of use. Extra coverage can also include jewelry protection, wedding dress damage, “change of heart,” and more. Some wedding insurance policies also pay for a new wedding if you have to postpone or cancel the event.

Let’s say the venue you booked has a flood and is unavailable for your big day. Maybe your photographer flakes out at the last minute and you have to book another vendor for twice the amount you budget. These are instances where filing a wedding insurance claim could save you thousands. Other examples include having all your gifts stolen, all the photos destroyed or a guest getting injured during the event.

The cost depends on how much coverage you purchase, the type of coverage you want and the deductible. In general, most policies start at $95 and go up to $500 if you add optional riders. Some venues actually require that you purchase wedding insurance, so make sure to find out if you even have a choice. They might also have special deals with providers or trustworthy recommendations.

Do you need wedding insurance?

Like any other form of insurance, it’s hard to know if you’ll really need it. But even if you hired the most reliable caterers and videographers, what’s to stop disaster from striking your area? Or your wedding dress getting stolen?

Couples looking to save money on their big day might see wedding insurance as just an extra hassle, but anything that can save you this much money is worth at least considering. If you’re lucky you won’t need it, but if something goes wrong you’ll be grateful to have it. That’s the basic gamble of insurance.

Before you buy a policy, look through your vendor contracts to see what’s covered. Some vendors have their own insurance policies, so you might already be adequately covered. Homeowners should also call their insurance agent to see if the liability portion of their homeowners insurance will cover their wedding.

How to buy wedding insurance

Popular wedding insurance companies include WedSafe and Wedsure, but most traditional insurance companies also offer wedding insurance. If you already have auto, renters or homeowners insurance, call that provider to see if they offer a wedding policy. You might get a special discount for adding a new policy.

Get as many quotes as you can before deciding, and make sure to compare each policy’s deductible, premium, types of coverage, coverage limits, number of days and types of events covered. For example, some policies will only cover your wedding day, while others will also pay for anything that happens during your rehearsal dinner or the day after. You can choose a basic liability policy or one that includes every a la carte option.