After picking up my wedding bands yesterday, I wanted to take the appraisal to the insurance company today, but it got me to thinking. What would happen if I had to replace my ring or the whole set and the cost of it had gone up since we purchased it? I checked into i t. My ring had indeed gone up by almost $1000. Well I would have had to suck it and pay the $1000 if my ring had been lost or stolen and I had not changed the appraisal paperwork. So ladies, please be sure to double check your paperwork and stay on top of it. Verify that you have the most current dollar value on your appraisals other wise you could be out of a lot of money should you ever have to replace your rings and have not kept up to date on your appraisals. Most jewelers will do this for you at no charge. Just take in the existing paperwork that you do have and ask them to update it for you and then take it back to your insurance company and you should be all set. Rather be safe than sorry.

Post content has been hidden

To unblock this content, please click here

Related articles

Rings & Jewelry

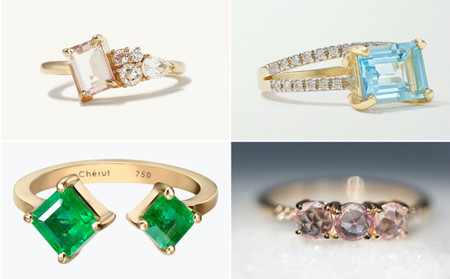

33 Non-Diamond Engagement Rings That Still Have Plenty of...

Not into everyday diamonds? Check out these colorful gemstones and unique...

Rings & Jewelry

The Biggest 'Bachelor' Engagement Rings of All Time

They said "yes" to the final rose—and an accompanying ring. But whose Bachelor...

Rings & Jewelry

The History of the Ring Finger—and Where to Wear Your...

Is it true that wedding rings are only worn on the left hand? We've got answers...